Houston’s rental market had a strong and steady year in 2025, showing clear signs of balance as both inventory and leasing activity increased without pushing rental prices higher. According to the Houston Association of Realtors’ December and full-year 2025 Rental Market Update, single-family rental homes across the Houston metro area experienced solid growth, giving renters more choices while keeping demand healthy. Throughout the year, the market benefited from increased supply, which helped prevent sharp rent increases and created a more flexible environment for tenants searching for homes.

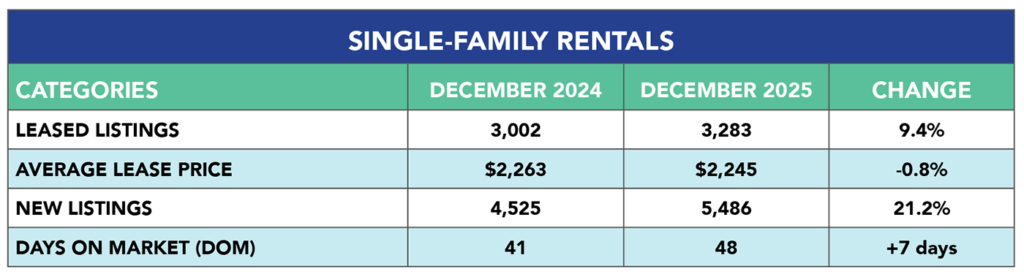

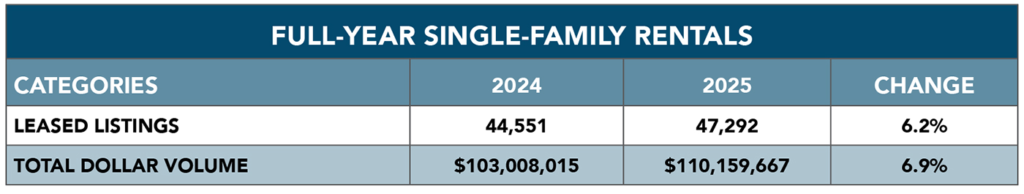

In December 2025 alone, Houston recorded 3,283 single-family rental leases, representing a 9.4 percent increase compared to December 2024. This increase in leasing activity shows that renters remain active across the region, even as more properties become available. For the full year, single-family rentals totaled 47,292 compared to 44,551 in 2024, marking a 6.2 percent year-over-year increase. These numbers confirm that rental demand in Houston remains strong, driven by population growth, job stability, and continued movement within the metro area.

One of the biggest factors shaping the Houston rental market in 2025 was the surge in available rental homes. New single-family rental listings jumped 21.2 percent year over year, with 5,486 new listings added to the Multiple Listing Service in December compared to 4,525 the prior year. This record-level inventory gave renters more flexibility than they have had in recent years, allowing them to compare neighborhoods, home sizes, pricing, and lease terms rather than feeling pressured to make quick decisions. Increased inventory also helped stabilize pricing across the market.

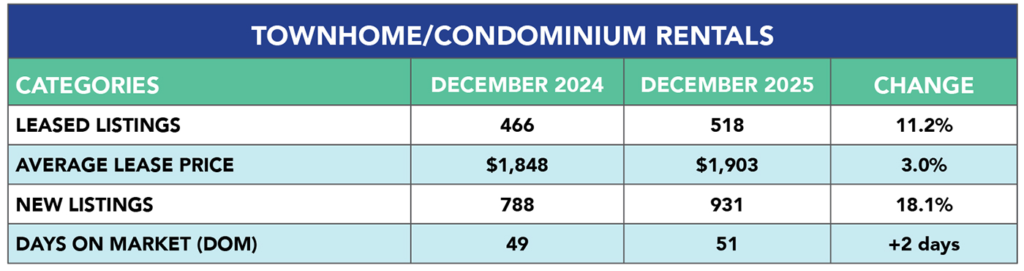

Rental prices throughout Houston remained largely unchanged for much of 2025. The average lease price edged down slightly by 0.8 percent in December to $2,245, marking the sixth consecutive month of statistically flat pricing. This trend highlights a more balanced rental environment where strong demand is being met with adequate supply. For renters, this stability provides predictability and affordability, while for homeowners considering renting out a property, it reinforces the importance of pricing accurately based on current market conditions rather than past peaks.

Homes also took slightly longer to lease as inventory expanded. Days on Market increased from 41 days to 48 days in December, the highest level since February 2019. While this represents a shift from the fast-moving rental market of recent years, it does not indicate weakening demand. Instead, it reflects a healthier pace where renters have time to evaluate options and landlords must focus more on presentation, condition, and professional marketing to attract qualified tenants.

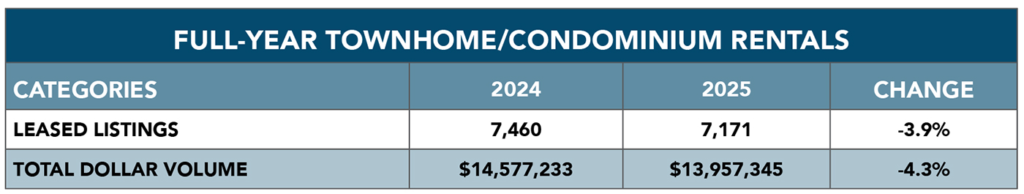

Despite stable pricing, the overall performance of the Houston rental market remained strong. Total dollar volume for single-family rentals rose 6.9 percent year over year to $110.2 million in 2025. According to Houston Association of Realtors Chair Theresa Hill, the growing supply of rental homes gave renters more flexibility throughout the year while steady demand kept leasing activity moving at a healthy pace without putting upward pressure on prices. Even as interest rates begin to ease, rental demand across Houston is expected to remain strong moving into 2026.

For renters, this market creates opportunity with more options, less urgency, and better leverage when searching for the right home. For homeowners, it remains a viable time to lease a property, but success depends on strategic pricing, strong marketing, and realistic expectations. For buyers currently renting, stable rental prices may also create the space to reevaluate long-term goals and explore whether homeownership could make sense in today’s market. If you are trying to decide whether renting, buying, or leasing out a home is the right move for you, having clear data and local insight makes all the difference. I am always happy to walk through the numbers, compare options, and help you make the best decision based on your goals and the current Houston real estate market.

If you have questions about the Houston rental market, are thinking about renting, buying, or leasing out a home, or simply want help understanding your options, I’m always happy to help. Every situation is different, and having accurate local data makes a big difference when deciding your next move. Whether you are relocating, downsizing, upsizing, or trying to decide if renting or buying makes more sense in today’s market, I can walk you through the numbers and help you create a clear plan. You can contact me directly at 281-400-0414, email me at evan@evanhitch.com, or visit my website at evanhitch.com to learn more. I proudly serve Houston, Fort Bend County, Katy, Richmond, Rosenberg, Fulshear, Brookshire, and surrounding areas, and I look forward to helping you navigate your next real estate decision with confidence.

Evan Hitch, MBA

REALTOR® | Southern Trust Realty

Phone: 281-400-0414

Email: evan@evanhitch.com

Website: evanhitch.com

#evanhitch #HitchYourFuture #HoustonRealEstate #HoustonRentalMarket #FortBendCountyRealEstate #KatyTXRealEstate #RichmondTXRealEstate #SugarLandTXRealEstate #HoustonHomes #TexasRealEstate